All Categories

Featured

Table of Contents

That indicates having an emergency fund in area, a manageable degree of financial debt and ideally a varied profile of investments. Your crypto financial investments can come to be one more part of your profile, one that helps increase your total returns, hopefully. Take note of these five other points as you're starting to purchase cryptocurrencies.

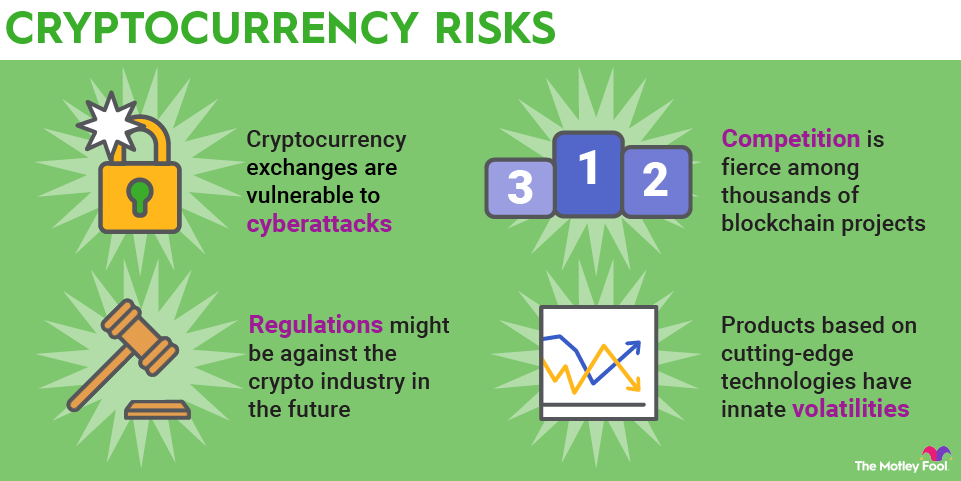

If you're buying stocks, it is essential to check out the yearly report and various other SEC filings to assess the business completely. Strategy to do the same with any type of cryptocurrencies, considering that there are literally hundreds of them, they all operate differently and new ones are being created every day. You need to comprehend the investment case for every trade.

That holds true for Bitcoin, as an example, where investors count specifically on somebody paying more for the possession than they spent for it. In other words, unlike stock, where a business can expand its revenues and drive returns for you this way, many crypto possessions need to count on the marketplace becoming more hopeful and bullish for you to make money.

If your financial investment is not backed by a possession or cash money circulation, it might end up being worth absolutely nothing. A mistake that many brand-new investors make is looking at the past and extrapolating that to the future.

How To Invest In Bitcoin And Altcoins Safely

What will drive future returns? Traders buying a cryptocurrency today need tomorrow's gains, not yesterday's. The costs of cryptocurrencies are about as unstable as a property can obtain. They could go down swiftly in seconds on absolutely nothing even more than a report that winds up confirming baseless. That can be wonderful for advanced investors that can implement trades quickly or that have a solid grasp on the market's basics, exactly how the market is trending and where it might go.

, each of whom is attempting to outgun various other deep-pocketed investors. A brand-new capitalist can conveniently obtain squashed by the volatility.

So as a more recent trader, you'll require to understand how finest to handle threat and develop a process that aids you reduce losses. Which procedure can vary from specific to person: Risk management for a long-term financier may just be never offering, no matter the rate. The long-lasting mentality enables the financier to stick with the placement.

The investor then purely complies with the policy to make sure that a reasonably tiny decrease doesn't end up being a squashing loss later on. More recent investors ought to take into consideration setting aside a particular quantity of trading money and afterwards making use of only a part of it, at the very least at first. If a position relocates versus them, they'll still have cash in get to trade with later on.

A Guide To Cryptocurrency Taxes In 2024

Selling a losing setting hurts, but doing so can aid you avoid worse losses later on. It's crucial to stay clear of putting cash that you require right into speculative assets.

Whether it's a deposit for a house or an important upcoming purchase, cash that you require in the following few years must be maintained in risk-free accounts to make sure that it's there when you need it. And if you're looking for a definitely sure return, your best choice is to settle high-interest debt.

Do not neglect the safety and security of any exchange or broker you're making use of. You may have the possessions legally, however a person still has to secure them, and their protection needs to be tight.

These include: Futures are an additional means to bet on the price swings in Bitcoin, and futures permit you to make use of the power of take advantage of to create substantial returns (or losses). Futures are a fast-moving market and worsen the already unstable relocate crypto. In January 2024, the Stocks and Exchange Compensation accepted several exchange-traded funds that spend directly in Bitcoin.

Best Defi Platforms For Earning Passive Income

So these ETFs can be a very easy way to purchase crypto with a fund-like product. Acquiring stock in a firm that's poised to make money on the increase of cryptocurrency no matter the winner might be an interesting choice, as well. And that's the possibility in an exchange such as Coinbase or a broker such as Robinhood, which derives a significant portion of its profits from crypto trading.

As a matter of fact, numerous so-called "free" brokers installed costs called spread mark-ups in the cost you pay for your cryptocurrency. Cryptocurrency is based on blockchain modern technology. Blockchain is a sort of data source that records and timestamps every entrance into it. The very best way to consider a blockchain resembles a running invoice of purchases.

Numerous crypto blockchain databases are run with decentralized computer networks. Some cryptocurrencies award those that verify the purchases on the blockchain data source in a procedure called mining.

Best Platforms For Crypto Lending And Borrowing

, however there are essentially dozens of others. Lots of traditional brokers likewise allow you to trade Bitcoin in addition to stocks and various other economic assets, though they have a fairly limited selection of other cryptocurrencies.

Leading gamers right here consist of Robinhood and Webull As repayment applications such as PayPal, Venmo and Cash Money App. If you're seeking to acquire Bitcoin, pay specific focus to the charges that you're paying. Here are various other key points to keep an eye out for as you're acquiring Bitcoin. An altcoin is an alternative to Bitcoin.

How To Safely Buy And Store Cryptocurrencies

Currently with a reported 15,000 or more cryptocurrencies around, it earns less feeling than ever to define the sector as "Bitcoin and after that whatever else." Cryptocurrency is a highly speculative area of the marketplace, and lots of clever capitalists have made a decision to put their cash somewhere else. For novices who intend to start trading crypto, however, the most effective advice is to begin tiny and only usage cash that you can afford to lose.

Editorial Please note: All financiers are encouraged to perform their own independent research study right into investment methods before making an investment decision. Furthermore, investors are advised that past investment product performance is no assurance of future cost recognition.

A Guide To Cryptocurrency Taxes In 2024

Cryptocurrencies often tend to be extra unpredictable than even more traditional financial investments, such as stocks and bonds. A financial investment that's worth thousands of dollars today could be worth just hundreds tomorrow.

Latest Posts

The Impact Of Bitcoin Halving On The Market

How To Get Started With Cryptocurrency Investing

A Beginner’s Guide To Crypto Trading